Infiltrating the EVM-I: Demystifying Smart Contracts & Auditing comprises of information about compilation breakdown of solidity code, the vulnerable components of blockchain ecosystem and how Smart contract auditing is crucial.

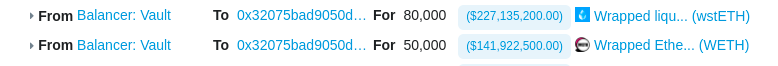

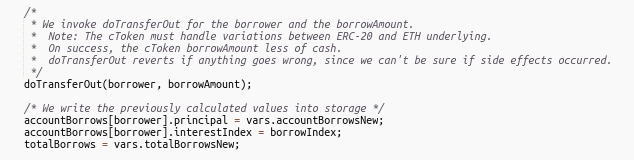

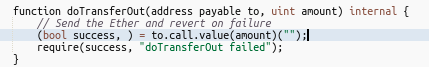

Rari capital got hacked for around $79M through a classic re-entrancy attack. Rari is a fork of compound finance that had this bug fixed earlier. It is not the first time Rari has been a victim of a hack.

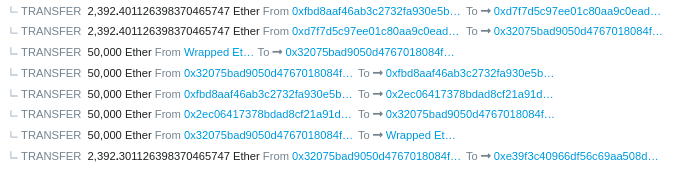

The attacker created 2 contracts.

There were 7 pools that were affected due to this exploit (8,18,27,127,144,146,156)

We will be focusing on this specific transaction to understand the hack.

https://etherscan.io/tx/0xadbe5cf9269a001d50990d0c29075b402bcc3a0b0f3258821881621b787b35c6

https://etherscan.io/address/0x49da42a1eca4ac6ca0c6943d9e5dc64e4641e0e3#code

Here is the Github repo that has POC for the hack.

Also, read Harvest Finance Hack Analysis & POC.

Infiltrating the EVM-I: Demystifying Smart Contracts & Auditing comprises of information about compilation breakdown of solidity code, the vulnerable components of blockchain ecosystem and how Smart contract auditing is crucial.

Chainpals transaction contract is responsible for handling the multi-phased transactions that take place between a buyer and a seller, each overlooked by escrow managers to make sure everything goes smoothly.

omposable smart contracts bring about certain problems in particular during the auditing phase. One of these is the hindering of end-to-end (E2E) testing. Often it is the case that for calling even just one function of a composable smart contract, multiple other contracts are required to be deployed.

The BonqDAO security breach that occurred on February 2, 2023, had far-reaching consequences for the platform, its users, and the wider DeFi ecosystem. The attack exploited a vulnerability in the integration of the Tellor Oracle system, which BonqDAO relied on for obtaining token price information.

Rain Protocol lets you build web3 economies at any scale.Rain scripts are a combination of low level functions (opcodes) like addition and subtraction and very high level functions like fetching an ERC20 balance at a given snapshot ID (Open Zeppelin), or fetching a chainlink oracle price.

In April 2023, Merlin DEX,a decentralized exchange (DEX) built on ZkSync, suffered a hack during a Liquidity Generation Event for its MAGE token, resulting in an estimated loss of $1.8 million from the protocol.

Unipilot is an automated liquidity manager designed to maximize ”in-range” intervals for capital through an optimized rebalancing mechanism of liquidity pools. Unipilot V2 also detects the volatile behavior of the pools and pulls liquidity until the pool gets stable to save the pool from impairment loss.

the source code review of Lightlink Bridge Validator and Keeper. The purpose of the assessment was to perform the whitebox testing of the Bridge’s validator and Keeper before going into production and identify potential threats and vulnerabilities.

Lets understand the smart contract storage model in Ethereum and EVM-based chains and how you can access the public and private variables of any smart contract deployed on the blockchain. We can do this by using cast storage.