The Dexible hack affected a total of 17 user accounts, with the majority of losses coming from a single address belonging to BlockTower Capital, a prominent investment firm.

The DeFiGeek Community (DFGC), established in February 2021, is a diverse and growing group dedicated to the development of decentralized finance (DeFi) applications and middleware that contribute to the Web3 era. With a membership that includes developers and enthusiasts alike, DFGC aims to create a hub for sharing accurate industry information and fostering collaboration. Among its projects are the Yamato Protocol, a crypto-backed stablecoin pegged to the Japanese yen (JPY), and the planned Yorozu, a peer-to-peer lending Dapp. As the community works towards becoming a decentralized autonomous organization (DAO), it emphasizes fluidity and the elimination of authority to allow for independent leadership and innovation.

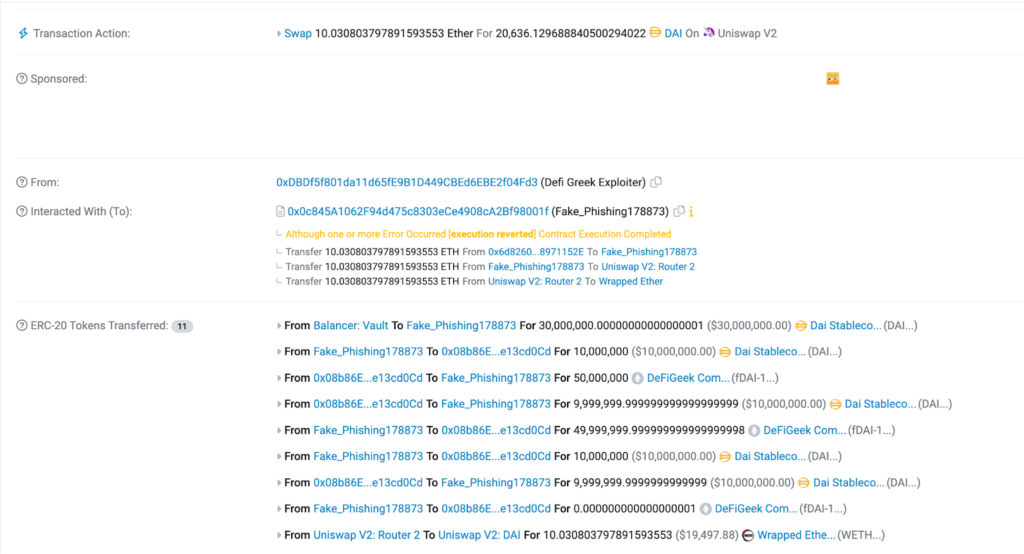

On Apr 17, 2023, the DeFiGeek Community fell victim to a security breach in which an attacker exploited a flash loan vulnerability, causing the loss of 10 ETH (valued at over $20,000) from their DeFiGeek Community Pool Dai (fDAI-102). The community has also committed to covering the lost funds through its treasury, mitigating the financial impact on its members.

Attack Tx hash: 0xa32c84ad09369880dfbdf01bcacc2de632ab8c49d97c33ef695fd0

Attacker address: 0xDBDf5f801da11d65fE9B1D449CBEd6EBE2f04Fd3

Attack Contract: 0x0c845a1062f94d475c8303ece4908ca2bf98001f

DeFiGeek Community Pool Dai (fDAI-102): 0x08b86e750ff8c816d8af

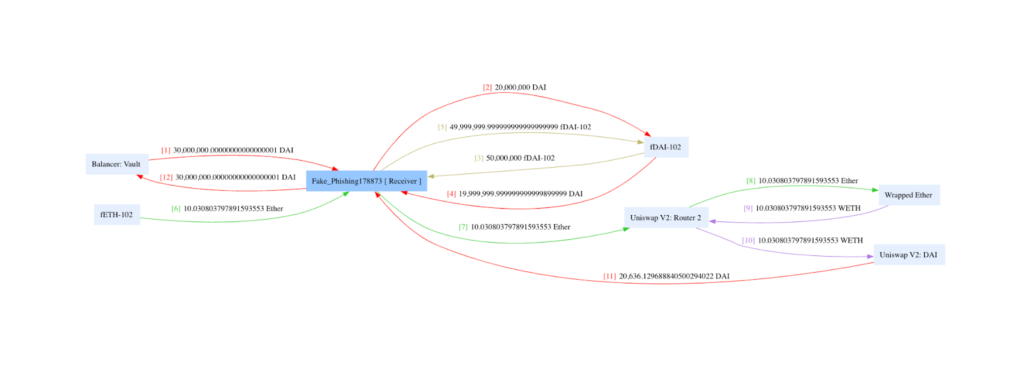

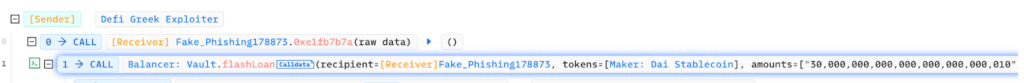

The attacker took out a flash loan from Balancer: Vault, acquiring a large amount of DAI (30,000,000 DAI) to exploit the DeFiGeek Community Pool vulnerability.

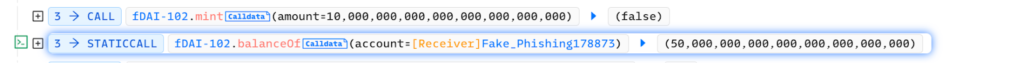

The attacker started interacting with the DeFiGeek protocol, sending 10M DAI to the protocol and receiving 50M fDAI-1 tokens in return, potentially manipulating the exchange rate between DAI and fDAI-1.

The attacker continued to send DAI and fDAI-1 tokens back and forth between their own address and the DeFiGeek protocol, potentially exploiting the vulnerability in the protocol to skew the exchange rate further in their favor. This included sending approximately 10M DAI and 50M fDAI-1 back to the protocol, and receiving approximately 10M DAI in return.

The attacker traded 10.03 WETH ($19,497.88) on Uniswap V2, obtaining 20,636.13 DAI ($20,636.13).

With the manipulated exchange rate now in their favor, the attacker likely used their acquired fDAI-1 tokens to withdraw more DAI than they initially deposited

The attacker returned the initial 30,000,000 DAI to Balancer: Vault, closing the loop on the flash loan.the attacker made a profit of 10 ETH, which is worth more than $20,000 at the time of the attack

The contract was subject to a vulnerability that allowed an attacker to exploit the system and make a profit. The flaw in the smart contract was related to an improper handling of the collateral factor (CF) and borrow cap, which the attacker took advantage of by borrowing a large amount of funds and interacting with the protocol in a specific way. This enabled the attacker to manipulate the exchange rate between DAI and fDAI-1 tokens, ultimately making a profit at the expense of the protocol.

In response to the attack, DeFiGeek initially set a zero supply cap for the unused token pool, but this measure was insufficient to prevent the exploit. To fully mitigate the vulnerability and prevent similar attacks in the future, DeFiGeek set the collateral factor (CF) and borrow cap to zero for the unused token pool. This action effectively disables the ability to use the problematic asset for borrowing or providing collateral, eliminating the possibility of an attacker exploiting the same flaw again. By setting the CF and borrow cap to zero, DeFiGeek secures the protocol against similar attacks., ensuring the safety of its users' funds.

The DeFiGeek Community hack serves as a reminder of the importance of robust security measures and best practices in the rapidly evolving DeFi landscape. As the sector continues to grow and attract more users, it is crucial to prioritize security and implement comprehensive audits, secure coding practices, and continuous monitoring for suspicious activities.

Additionally, fostering a security-conscious culture among developers and community members will help ensure that all parties involved remain vigilant in safeguarding against potential vulnerabilities and exploits. One of the recommended approaches to mitigating such risks is to engage third-party security audits from reputable firms, such as blockapex.io, to ensure that all possible vulnerabilities are identified and addressed in a timely manner. By staying proactive and vigilant, the DeFi community can continue to innovate and thrive in a secure and reliable environment.

The Dexible hack affected a total of 17 user accounts, with the majority of losses coming from a single address belonging to BlockTower Capital, a prominent investment firm.

A comprehensive introduction to smart contract security audit and preparation of relevant interview questions.

War Room is an immersive, high-energy environment incorporating a dedicated team of experts that comes together to form the backbone of the War Room. Read more in this part

BlockApex (Auditor) was contracted by Sonar(Client) for the purpose of conducting a Smart Contract Audit/Code Review of Sonar bridge modeule. This document presents the findings of our analysis which took place on 8th September 2021.

The Yearn Finance hack that occurred on April 13, 2023, resulted in the loss of approximately $11.4 million. The exploit was carried out through a misconfiguration in the yUSDT vault, revealing a flaw in the system's architecture.

Data has become the vigor of the digital age, powering industries, economies, and societies worldwide. Whether personal information, financial records, intellectual property, or trade secrets, data is the driving force behind decision-making, innovation, and business operations. However, data security has emerged as a paramount concern with the increasing digitization of our lives and businesses.

The main contract is called Chainpals Token. The minting and transfer of the complete supply is done during deployment. This means new tokens can only be minted if the old ones are burnt.

Fixing a bug in traditional software development is often likened to solving a difficult puzzle, each presenting its own challenges. This task has always been complex and time-consuming. However, resolving bugs in a blockchain system is even more demanding due to its transparent & permissionless nature and the high stakes involved with users' funds.

Harvest finance got hacked for around $34M due to a flashloan attack which manipulated the price in the Curve pool to retrieve more USDT tokens than originally deposited USDT amount in fUSDT pool.