As the non-fungible tokens market boomed, it was quickly realized that they can be leveraged. Have a look at NFT Lending and the risks associated in this detailed blog.

Introduction

Lending and borrowing are two sides of the same coin, i.e., “loan.” In a loan, an agreement takes place between two parties, a lender and a borrower. The lender gives specific amount of money to the borrower with the expectation of receiving it back with interest according to a pre-determined repayment schedule. The terms and conditions of such transactions are usually agreed upon by the parties involved, including the interest rate, repayment schedule, and any collateral that may be required. These agreements involve more factors and more risks for both sides.

One question that arises is, why would anyone want to give or take a loan?

Assets lending and borrowing create a gateway between people who have idle assets and people who may have strategies but don’t have assets. Lending and borrowing can help users in multiple things, such as

1. Access to liquidity

By borrowing against their assets, owners can access liquidity without having to sell their assets. This can be especially useful for owners who want to hold onto their assets for the long term but need cash in the short term.

2. Income generation

Lending can provide an opportunity for owners to generate income from their assets. By lending their assets to others, owners can earn interest on their loans.

3. Leverage

Borrowing against assets can provide leverage for traders and investors. By using collateral, traders and investors can access additional funds to invest in other assets.

4. Risk management

Lending and borrowing can also be used as a form of risk management. For example, an owner who believes that the value of their asset will decrease may choose to borrow against it to hedge against potential losses.

NFT Loans

In the web3 space, the initial implementations were of traditional finance moving to blockchain, hence introducing DeFi. There are many exchanges that offer loans against collateral, the concept of which is not new, but the evolution presented the idea of flash loans.

As the NFT market boomed, it was quickly realized that these non-fungible assets sit idle in the wallet. These NFTs could be leveraged. So, in January 2020, Alex Masmej had a survey in a closed Telegram community and found that people were willing to put NFTs at stake and get loans against them.

So, the “RocketNFT” was created. The mechanism is pretty straightforward, with a DAO controlling the decisions.

- For a loan under 4000$, Users will lock their NFTs, and via a form, they explain where they intend to use these loaned funds.

- A lending pool that is based on Maloch DAO (public good funds on Ethereum).

- The DAO then makes its decision and give out loan in DAI.

This mechanism is quite simple, but a few main problems in this approach are

- Since the DAO is focusing on improving the Ethereum ecosystem, borrowers cannot get loan for any other purpose.

- The maximum amount of loan a borrower can get has a limit.

The platform didn’t have a marketplace and proved to be more of an experiment. Nevertheless, it served as a stepping stone that gave a good outlook on the peer-to-pool model. The pool was listed at Gitcoin grants and was closed down after a few months of running.

Peer-to-Pool Lending Model

The peer-to-pool lending model is a type of decentralized finance (DeFi) lending model where borrowers can obtain loans from a pool of funds supplied by individual lenders. It is also known as a peer-to-contract or peer-to-protocol model.

In this model, individual lenders contribute their funds to a lending pool. The pool then uses these funds to offer loans to borrowers who have collateral to offer. Borrowers pledge their collateral (which could be cryptocurrencies or NFTs) to the pool, which then determines the loan-to-value (LTV) ratio and the interest rate for the loan.

There are a number of things to consider in this model, such as

- In the peer-to-pool model, the pool acts as an intermediary between lenders and borrowers, and the pool decides on the terms of the loan.

- Then, there are liquidity risks; if multiple lenders demand withdrawal, then the pool will lack liquidity and won’t be able to give out loans.

- In a peer-to-pool model, the success of the platform and the performance of the loans are dependent on a limited number of borrowers and lenders. If there is a high concentration of risk among a few borrowers or lenders, it can lead to losses for the entire pool.

Drops NFT

The peer-to-pool lending model got an upgrade with “Drops NFT.” What this platform did differently is they introduced NFT risk profiles. The protocol divides NFT types

- Ocean – blue chip NFTs with the highest liquidity and low-risk collateral.

- Sea – Mid-cap NFTs with medium-risk collateral.

- Lake – Lower cap NFTs with high-risk collateral.

In this mechanism, lenders choose what pool they want to get exposed to, getting somewhat control over investing their assets. The value of these NFT collaterals is determined by oracles. To hedge lenders' risk, the collateral is usually greater than the loan amount, so in drops NFT, borrowers get 30-60% loan against the collateral NFT. The platform doesn’t have a due date to repay the debt. However, once the borrower exceeds the borrower limit, the collateral is liquidated.

Risks involved with this model are

- For borrowers, if they got a loan of 30-60%, but NFT is liquidated, they lose an NFT worth of greater value.

- Once the borrowing limit is exceeded, anyone can repay the debt and seize the NFT.

- Although borrowers can avail the option of refinancing, however, the problem of NFT being illiquid still resides.

Three-Actor Lending Model

Another lending model is the three-actor model, which is a lending and borrowing model that involves three parties: borrowers, lenders, and strategists.

- Borrowers offer NFTs as collateral and connect their wallets to the platform.

- Lenders provide liquidity to the lending pool.

- Strategists, who act as intermediaries, create public vaults to attract liquidity and customize the loan terms for each collateral.

In this model,

- Borrowers connect their wallets to the lending platform and list NFTs to use as collateral.

- Strategists create public vaults with customized loan terms for each type of NFT collateral. They define loan-to-value ratios, interest rates, and other terms that are specific to the type of NFT being used as collateral.

- Lenders search for a public vault that aligns with their investment strategy. They can browse through various vaults based on the NFT collateral, LTV, and APR offered.

- When a borrower lists their collateral, strategists use a set of oracles to automatically appraise the NFT and match it with a public vault with sufficient liquidity.

- Borrowers can then select the loan amount, APR, and duration available in the chosen vault.

- Finally, borrowers review and approve the loan, executing the transaction.

The three-actor model simplifies the lending process by customizing loan terms for each collateral, making it more efficient than traditional lending models. This model provides flexibility for borrowers and lenders while strategists act as intermediaries, providing a fair and transparent platform for lending and borrowing.

Astaria is the first platform that introduced this model, and the above describe way is exactly how Astaria works.

The risk associated with this model

- It heavily relies on intermediary strategists.

Peer-to-Peer Lending Model

The main shortcoming of peer-to-pool lending model and three-actor model can be catered with peer to peer lending model.

NFTFi

Another platform that enables NFT lending is NFTfi. On NFTfi, lenders can earn interest by loaning out their NFTs to borrowers for a specified period of time, while borrowers can use the NFTs as collateral for loans. The platform also provides a marketplace for users to buy and sell NFTs, and it uses a reputation system to help with filtering individuals in the marketplace.

How NFTFi works

- Borrowers list NFT on the platform.

- Lenders make offers specifying the time and loan amount.

- When the borrower accepts the offer, the NFT is locked in an escrow contract, and the borrower receives the loan in wETH, DAI, or USDC.

- The borrower will have to repay to loan to get NFT back.

- In case the borrower is unable to return the loan in the agreed-upon time, the lender forecloses the loan and gains ownership of the NFT, whereas the borrower gets to keep the loan.

Pros and Cons

The biggest advantage of such a platform is that the lenders and borrowers decide the terms and conditions.

On the other side,

- The assets NFTfi offers loans in are not diverse.

- Furthermore, if we take a look at the case in which the borrower failed to return the loan back. The borrower may lose a rare asset

- In another case, the lender may end up with a NFT of no value, which is the risk any peer-to-peer lending model will face.

(Note that borrower may choose not to payback the debt, if the value of NFT falls below the loan repayment amount)

Whys of Peer-to-peer Lending

Peer-to-peer lending model is a convenient way to remove the intermediary. In P2P model, the deal takes place between individual lenders and borrowers. The parties enter a negotiation to find the offer that both parties agree on.

- This model provides more flexible loan terms, which the parties can negotiate as per needs.

- Without a marketplace, it is quite difficult to find the right lending or borrowing opportunity, so most of the times peer to peer model is integrated with a marketplace platform which serves as a bridge between the two parties.

- These marketplaces charge some fee. For example, NFTfi takes 5% of the interest earned by the lender on successful loans.

Risks Involved

Let’s take a look at some risks associated with this model

- Collectors may put NFTs as collateral for a loan. But in conditions where NFT is rare or worth more than the loan, the borrower has a risk of losing it.

- As the NFT market fluctuates a lot, the lender can end up with a worthless NFT. (Note that borrower may choose not to payback the debt, if the value of NFT falls below the loan repayment amount)

- If the NFT market is illiquid, then the lender may have trouble selling it.

- The expiration duration at times serve as a trouble for the borrowers.

Hybrid Liquidity Market

Two main problems that peer-to-pool and peer-to-peer models face are

- The illiquid NFT marketplace.

- The NFTs are locked in escrow contracts as collateral which renders them unusable.

Hybrid market tried to have more liquidity in market using both p2p and p2pool at one place

SodiumFi

SodiumFi aimed to combine P2P flexibility and P2Pool efficiency. P2P flexibility refers to the lender having more control over defining personal risk-reward strategies based on collateral valuation and earning via private cross-collection liquidity pools. The P2Pool model offers more efficiency for loan fulfillment and high LTV (loan-to-value) ratios. The loans in this platform have an ending duration.

Sodiumfi somewhat takes care of the problems mentioned as

- The lending AMM in Sodiumfi determines the interest rate and LTV (Loan-to-Value) ratio of each loan based on the supply and demand of liquidity. The interest rate is set based on the utilization rate of the liquidity pool, which increases as more borrowers take out loans. This ensures that interest rates remain competitive and reflect the actual market demand for NFT-backed loans.

This doesn’t really solve the problem of lack of liquidity in the NFT market but provides better deals for both the lenders and borrowers.

- In SodiumFi, the NFTs which are put forward as collateral are moved to an isolated Sodium wallet, enabling NFT owners to retain their digital asset's utility. For example Borrower can use the NFT he owned even after he transferred it to SodiumFi, although the owner cannot transfer ownership again till the conditions of the terms set are dealt with.

Peer-to-peer Perpetual Lending

While peer-to-peer lending comes close to a good solution, it could use evolution. So, now we have a peer-to-peer perpetual lending model. It is identical to the peer-to-peer lending model, except this doesnt have an expiration date.

Then, how do lenders or borrowers exit positions? There are different mechanisms used to take care of this. We talked about drops NFT above in which there was no expiration date, so the mechanism was set that borrowers would get liquidated upon crossing the borrowers limit.

A more formal way to look at Peer-to-peer perpetual lending is it is a type of lending model where borrowers and lenders directly interact with each other to establish loan terms that do not have a set expiration date. In this model, lenders provide loans to borrowers without requiring the loan to be paid back by a specific date. Instead, the loan remains in place indefinitely until the borrower repays the principal and any accrued interest.

In the context of NFT lending, perpetual peer-to-peer lending can involve borrowers pledging NFTs as collateral for a loan. The lender would hold onto the NFTs until the borrower repays the loan, at which point the NFTs would be returned to the borrower.

The perpetual peer-to-peer lending model can provide benefits for both borrowers and lenders. Borrowers may be able to negotiate more favorable loan terms, while lenders have the potential to earn ongoing interest on their loans. However, this model also comes with additional risks, particularly for lenders, who may need to monitor their loans more closely to ensure that they are not exposed to excessive risk.

The concept of perpetual lending of NFTs is relatively new and came around with Blend, the lending model built for the platform named “Blur”.

Blend

Blend is a unique peer-to-peer perpetual lending protocol that allows lending against arbitrary collateral, such as NFTs. This enables the buy now, pay later option for users. The protocol enables borrowers to borrow funds against their NFTs while retaining ownership of their asset. At the same time, lenders can earn interest on their funds by lending them out. Blend's off-chain offer protocol matches borrowers with lenders, allowing them to choose the most competitive rates.

Unlike most NFT-backed lending protocols, Blend has no oracle dependencies or expiries, allowing borrowers to keep their positions open as long as someone is willing to lend against their collateral. Blend supports liquidations before expiry, enabling lenders to exit their positions by triggering a Dutch auction to find a new lender at a new rate. If that auction fails, the borrower is liquidated, and the lender takes possession of the collateral.

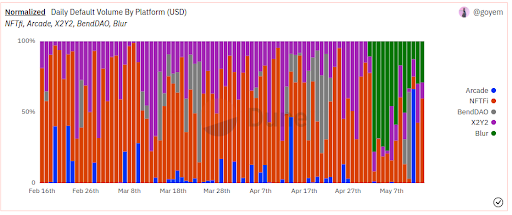

The blend was launched on blur for three NFT collections, i.e., Cryptopunks, Azuki, DeGods and Miladies. Before this, Blur wasn’t on the radar of most users, however, with the launch that changed. This dashboard is a proof of that

How Blend Works

In this section, we will have a look at the workflow of Blend

For Lenders

- Connect and fund wallets: Lenders start by connecting and funding their wallets with the assets they want to lend.

- Choose lending parameters: Lenders specify the maximum amount they are willing to lend using a single NFT within a specific collection as collateral.

Lenders can set the loan's desired annual percentage yield (APY).

- Wait for borrower acceptance: Lenders wait for borrowers to review and accept their loan terms, including the interest rate and loan amount.

- Loan repayment: Lenders have two options for loan repayment.

- They can either receive repayment by selling the borrowed NFT on the platform, which automatically pays back the loan plus interest.

- Or they can choose to receive full repayment and allow the borrower to keep the NFT.

- Request repayment: Lenders can request repayment at any time. If repayment is requested, the borrower has 30 hours to pay back the loan.

- Claim accrued interest: Lenders can close the loan at any time and claim the interest accrued up to that point.

For Borrowers

- Connect and fund wallets: Borrowers connect their wallets and fund them with the necessary assets.

- Use NFTs as collateral: Borrowers use their NFTs as collateral to access ETH liquidity.

- Select loan terms: Borrowers submit an NFT and request a loan amount and interest rate.

- Review loan offers: Borrowers review loan offers from lenders, considering the price and interest rate options available to them.

- Agree to loan terms: Borrowers agree to the loan terms and the specified interest rate.

- Loan repayment options: Borrowers have two main options for loan repayment.

- They can either sell the borrowed NFT on the platform, which automatically pays back the loan plus interest.

- Or they can choose to pay off the loan in full and retain ownership of the NFT.

- Auction process: If a lender requests payment, the loan is sent to a Dutch auction, where the interest rate gradually increases until a buyer accepts the offer. If no buyer is found after 6 hours, the auction closes, and the borrower has 24 hours to repay the loan. Failure to repay within this period results in the liquidation of the NFT used as collateral.

Pros

- The no expiration date feature is beneficial for borrowers as it avoids harsh penalties such as confiscation of their NFT in the event of expiry.

- No Expiration is convenient for borrowers as they no longer need to remember to close their debt positions.

- The lender can exit the loan at any time by refinancing.

- Lenders can choose to offer loans to established collections at low rates, or to more volatile ones at higher rates, depending on their risk profile.

- The borrower can repay the loan at any time.

Cons

- There may be times when nobody is willing to take the lender's position in the case of refinancing.

- Liquidation occurs when no one is willing to take over the debt at any interest rate after Dutch auction, the lender can end up with an NFT with a value below the repayment loan amount.

- Lenders can demand loan repayment at any moment, initiating a Dutch auction to locate a new lender — in the absence of a new lender, the NFT will be liquidated.

- Manually closing positions costs gas which is taken out of lending yield most of the time.

- Lenders face high risk as they have to keep tracking the value of the NFT.

TL;DR

Non-fungible tokens (NFTs) can be used as collateral for loans in various lending models. NFT lending offers benefits such as access to liquidity, income generation, leverage, and risk management. Different lending models such as peer-to-pool lending, three-actor lending, peer-to-peer lending, and hybrid liquidity markets, each model has its advantages and risks, such as the potential loss of valuable NFTs or illiquidity in the NFT market. The latest development is the peer-to-peer perpetual lending model, which allows borrowers and lenders to establish loan terms without a set expiration date. Blend is a lending protocol that enables peer-to-peer perpetual lending using NFTs as collateral, providing flexibility for borrowers and opportunities for lenders to earn interest.

Also read our Hack Analysis on DEUS DAO.

BlockApex

BlockApex  November 1, 2023

November 1, 2023